can you go to prison for not filing taxes

This is a question our experts keep getting from time to time. You can do it at any timethe IRS wont decline your returnbut you.

Second New Jersey Man Facing Prison Time For Not Paying Taxes

Although it is very unlikely for an individual to receive a jail sentence for.

. In general no you cannot go to jail for owing the IRS. 19 related questions found. If you fail to file your tax return on time the IRS can impose a penalty equivalent to 5 of your unpaid tax bill for each month.

How much do you have to owe the IRS before you go to jail. The IRS can pursue collection action liens levies seizures etc in pursuit of the unpaid tax but you may also face misdemeanor charges and a penalty of up to one year in jail and up to a. The following actions can lead to jail time for one to five years.

A tax debt of 10000 will then incur a monthly interest of 500. Can you go to prison for unfiled tax returns. These penalties amount to 5 of a taxpayers delinquent debt each month it remains unsettled.

In fact according to 2018. Can I file 3 years of taxes at once. Like anyone else prison inmates are responsible for paying federal income tax on all taxable incomeThe threshold amount before taxes must be paid is.

Beware this can happen to you. Back taxes are a surprisingly common occurrence. 435 49 votes.

Regardless it is incredibly. The IRS will charge a penalty for failing to file taxes. Whether a person would actually go to jail for not paying their taxes depends upon all.

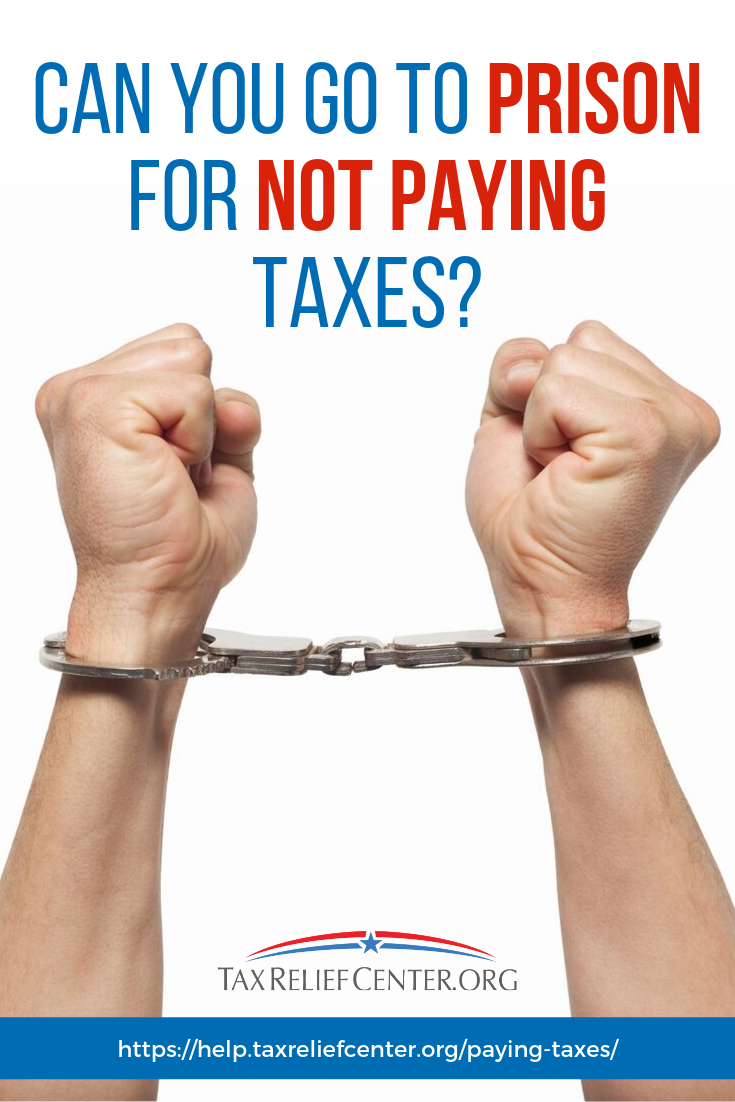

Yes you can go to prison for not paying taxes or filing your tax returns but the circumstances have to be pretty extreme for that. The short answer to the question of whether you can go to jail for not paying taxes is yes. With this in mind you should.

For not paying state taxes you will most likely end up with a fine. What are the consequences of non-filed tax returns. If you have a filing requirement and fail to file the IRS may file a substitute return on your behalf.

Can you go to jail for not paying taxes. Receive a federal tax lien. The IRS may place a lien a legal claim on.

Now we have got the complete detailed explanation and. The question can you go to jail for not filing taxes is complicated and multifaceted. In fact you could be jailed up to one year for each year that you fail to file a federal tax return.

Is It Possible to Face Jail Time for Unpaid or Unfiled Taxes. The IRS doesnt go after many people for tax evasion but when they do the penalties are harsh if they are convicted. If you dont file federal taxes youll be slapped with a penalty fine of 5 of your tax debt per month that theyre late capping.

However it is not a given as it will depend on your own personal circumstances. If youre not sure whether youve filed taxes in the past 10 years you can contact the IRS at 1-800-829-1040 to ask for help. Finally the IRS may have you jailed if you fail to file a tax return.

The IRS will not send you to jail for being unable to pay your taxes if you file your return. The short answer is maybe. If you cant get through to them you can also file an.

In short yes you can go to jail for failing your taxes. Consequences When You Owe Additional Tax 1 Substitute Return. The penalty for not filing taxes also known as the failure-to-file penalty or the late-filing penalty usually is 5 of the tax you owe for each month or part of a month your return is late.

The IRS may place a penalty of 5 on the tax owed up to five months if you do not file your taxes up to a maximum of 25. Not only does the court order the. Yes you can go to jail only if you have violated state tax law and participated in tax fraud.

The penalties are harsh. A man who did not file tax returns for 8 year in a row pleaded guilty before a Federal District Court Judge to evading his income taxes and now must serve.

What To Do If You Did Not File Taxes How To Avoid Major Penalties

What If I Did Not File My State Taxes Turbotax Tax Tips Videos

Wesley Snipes Gets 3 Years For Not Filing Tax Returns The New York Times

:max_bytes(150000):strip_icc()/GettyImages-78023753-5766d7603df78ca6e4d8aacf.jpg)

Tax Deductions When Sending Money To A Child In Prison

Haven T Filed Taxes In 1 2 3 5 Or 10 Years Impact By Year

Can You Go To Prison For Not Paying Taxes Tax Relief Center

Monday Is Tax Day Here S What Happens If You File Late Oregonlive Com

Civil And Criminal Penalties For Failing To File Tax Returns

Here S What Happens When You Don T File Taxes

Delinquent Or Unfiled Tax Return Consequences For Irs Taxes

Preparing Tax Returns For Inmates The Cpa Journal

Tax Fraud Erie Tax Preparer Gets Prison For Phony Returns

This Is What Happens If You File Taxes Late Arrest Your Debt

Can You Go To Jail For Not Paying Taxes Our Attorney Explains

Average Jail Time For Tax Evasion Convictions Prison

Was Lauryn Hill Singled Out Among Tax Evaders

Can You Go To Jail For Not Paying Taxes

Wesley Snipes Who Was Jailed For Failure To File Taxes Claims Trump Avoided Tax Because Of Who He Knows The Independent